Amazonâs answer to Temu and Shein is here.

On Wednesday, the US e-commerce juggernaut introduced Haul, its long-rumoured rival to the fast-growing, ultra-inexpensive Chinese retailers. The site is filled with home goods, electronics, beauty accessories and lots of fashion, all for under $20. Shoppers will find body-hugging dresses with asymmetrical cutouts for $19, barefoot-style sneakers for $13 and high-waisted flare leggings for $9.

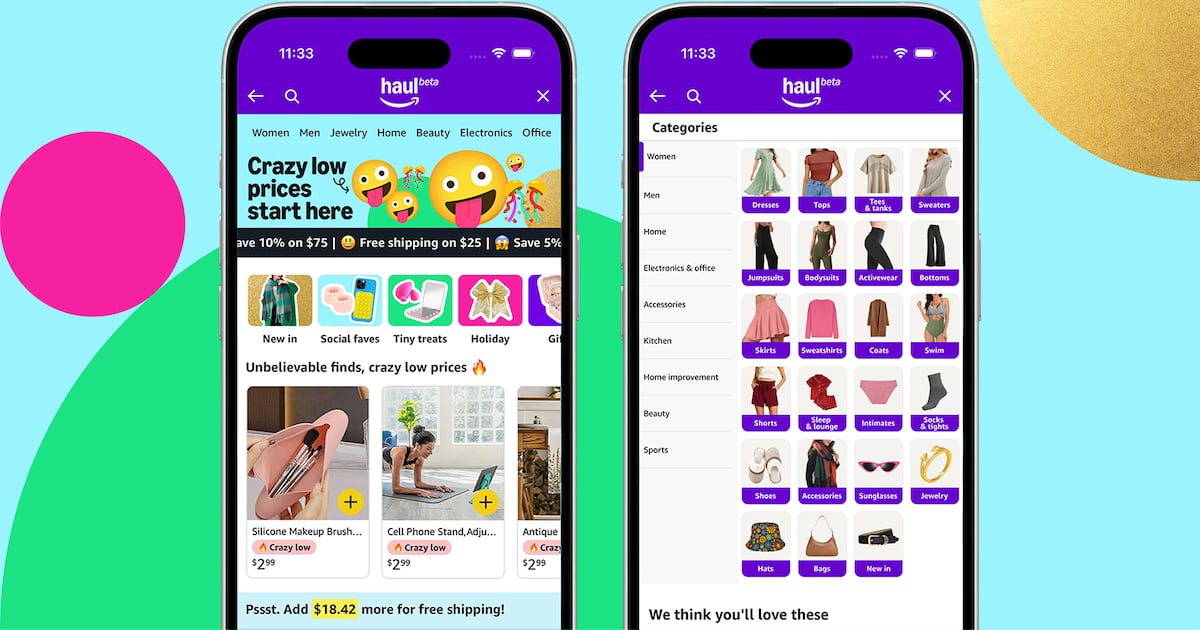

The design seems aimed directly at young consumers. There are emojis everywhere, including animated ones on a banner declaring âCrazy low prices start here.â Even the name references the popular âhaulâ videos on social media.

While Amazon has taken previous steps to counter its new rivals, such as reducing fees to lure their merchants, Haul is its most direct response yet to increasing pressure from Temu and Shein, which have made inroads into its territory with their extremely low prices. Credit-card data analysed by Earnest Analytics earlier this year found that 96 percent of Temu customers also shopped on Amazon â but while it estimated Temuâs US sales grew 840 percent between January 2023 and 2024, Amazon reported growth in product sales of about 5.3 percent for the year. (Amazonâs figures were global but the US is by far its largest market.)

Haul copies its competitionâs playbook, shipping products straight from warehouses overseas â often in China â to US customers at bargain-basement prices. However, that model comes with a different sort of cost that is decidedly un-Amazon. The company made its name on low costs combined with convenience and super-fast shipping, frequently two days or less. On Haul, âtypical delivery timesâ are one to two weeks, Amazon said in its announcement.

âItâs almost a bizarre twist to the history of Amazon and to the things itâs been building for so long,â said Juozas Kaziukenas, founder of market research firm Marketplace Pulse. By offering customers even lower prices on certain items if theyâre willing to wait, âAmazon is in some ways admitting that e-commerce is not one-dimensional.â

Still, it may not be enough to slow down Temu and Shein.

Haul, currently in beta, is only available through Amazonâs app or on its mobile site for now. Kaziukenas compared it to other niche shopping channels Amazon has launched over the years, like its home for high-end goods, called Luxury Stores; its Etsy clone, Amazon Handmade; or its TikTok Shops competitor, Inspire.

âIt has many of these sections of Amazon that theoretically exist yet in practice are not seen by many consumers,â Kaziukenas said. â[Haul] feels like a reaction and like a sort of a hobby project.â

Unless Amazon makes Haul easy for shoppers to find and puts marketing dollars behind it, it seems likely to remain a low-profile experiment. Kaziukenas isnât expecting the retailer to run ads for it during the Super Bowl â like Temu did last year â and thinks, for now at least, Temu and Shein probably donât have much to worry about.

But that could change if Amazon begins to view Shein or Temu as a bigger threat. As of August, Temuâs share of US online sales was 0.71 percent, while Shein claimed 0.54 percent, according to insights firm Consumer Edge. Amazon remained the clear leader with a 17.9 percent share.

The companies have their own challenges to conquer, too, before they come for Amazonâs crown. While Shein weighs an IPO, its sales growth has slowed, dropping to 23 percent for the first half of the year compared to 40-percent growth the year before, with earnings also plummeting, according to The Information. Temu-owner PDD Holdings recently warned of its own slowdown, sending its stock tumbling.

US officials, meanwhile, are contemplating closing the loophole that lets the companies dodge duties â and keep prices so low â on deliveries to US customers. A further hurdle is on the horizon with president-elect Donald Trumpâs campaign promise of placing hefty tariffs on Chinese goods. (These factors would also hit Amazon Haul purchases, sending prices up. Amazon said in an email it will adapt as needed to comply with customs requirements.)

But Haulâs arrival is an indication that Amazon canât ignore Temu and Shein either. Theyâve grown remarkably fast, fuelled by unrelenting drops of new products at costs that once seemed unimaginably low for any business trying to actually make money. In the process theyâve shaken up the fast-fashion market and put a scare into the king of online retail.

Kaziukenas pointed to a 2007 Harvard Business Review interview with Amazon founder Jeff Bezos, where he said of the companyâs customers, âI canât imagine that 10 years from now they are going to say, âI love Amazon, but if only they could deliver my products a little more slowly.ââ

It turns out they donât mind waiting, if the price is low enough.

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

Burberry unveils turnaround plan. The £40 million ($50.7 million) cost-cutting programme comes as new chief executive Joshua Schulman pledges to âstabilise the businessâ and refocus on the brandâs heritage in order to revive the fortunes of the ailing British luxury fashion brand.

Tapestry and Capri call off their merger. In announcing the termination, the Coach-owner said it would buy back stock. Capri outlined a turnaround plan that includes closing some Michael Kors stores.

Shopify surges after third quarter revenue beats estimates. Revenue for the period rose about 26 percent to $2.16 billion. Third-quarter operating income was $283 million, compared with analystsâ estimates of $337 million.

Moncler not in talks to take over Burberry, Reuters reports. According to Reuters, four sources close to the matter denied a report by Britainâs Mail on Sunday that a bid by Moncler was imminent. Shares in the British luxury brand fell after the report, and were last down 2.2 percent.

JDâs results fail to impress as Chinese economic fears persist. JD.com Inc.âs quarterly revenue rose 5.1 percent, a moderate expansion that suggests Chinese consumers are only cautiously spending again. Sales rose to 260.4 billion yuan ($36 billion) for the three months ended September.

Groupe Dynamite aims for $1.7 billion valuation in Canadian IPO. The company behind the Garage and Dynamite chains said in public filings that CEO Andrew Lutfy expects to offer subordinate voting shares in the range of C$19 to C$23 ($13 to $16) per share. Lutfy would retain about 87 percent of the company and 98.5 percent of the voting rights.

Boohoo raises £39 million. The British fast-fashion retailer completed a share placing and subscription, £6 million of which will be replaced through a retail offer, subject to demand. Boohoo also called on shareholders to vote against Frasers Groupâs demand for a seat on its board.

Dolce & Gabbana to collaborate with Skims. The tie-up between Kim Kardashianâs shapewear and intimates label and the Italian luxury brand aims to expose each othersâ customer bases to new aesthetics and price points. The collection is set to launch next week.

H&M to collaborate with Glenn Martens. The buzzy Belgian designer, known for his work at Y/Project and Diesel, will create a collection for the Swedish fast-fashion giant as part of a wider push to reassert H&Mâs fashion credentials.

UK Prime Minister Keir Starmer plans to leave scrutiny of Shein IPO to UK regulator. The UK government plans to defer scrutiny of Sheinâs potential London stock listing to the Financial Conduct Authority. In doing so, it avoids a deeper examination of the Chinese retailerâs labour practices despite calls from some Labour MPs to strengthen protections.

Alibaba, JD tout Singlesâ Day highs while China economy sags. Alibaba said the number of paid 88VIP members who placed orders grew by 50 percent, while smaller rival JD said customers increased by more than 20 percent. However, selective disclosures from tech leaders paint an incomplete picture of whether Beijingâs effort to rejuvenate the economy is working.

THE BUSINESS OF BEAUTY

Open AI partners with Estée Lauder on research and development. The company has created 240 new generative pre-trained transformers, or GPTs, to develop and market new products. ELC reportedly began using generative AI in its customer service interactions as recently as late 2023, and established an âAI Innovationâ lab earlier this year.

PEOPLE

Peter Do exits Helmut Lang. Do joined Helmut Lang in March 2023, with a goal to revive the storied house. He will exit the brand at the end of November; the pre-fall 2025 collection will be his final for Helmut Lang.

LVMH moves Alexandre Arnault to headquarters, fuelling succession talk. Arnault is exiting his role at Tiffany in the conglomerateâs latest executive shakeup. Heâll become deputy CEO of the groupâs wine and spirits unit, Moët Hennessy, under Jean-Jacques Guiony.

Phillip Lim exits 3.1 Phillip Lim. Chief executive and co-founder Wen Zhou will take sole control of the brand while Lim will âpursue new ventures,â according to a statement from Lim and Zhou.

LVMHâs Sophie Brocart heads to Chanel in a new sustainability role. Brocart has been CEO of ready-to-wear label Patou since 2018, working to relaunch the line alongside designer Guillaume Henry. More details on Brocartâs future role at Chanel are not yet known, but circularity is a key topic for luxury brands as they seek to curb their environmental footprint.

LVMH HR chief Chantal Gaemperle exits group. The Swiss executive joined LVMH in 2007 from food and beverage conglomerate Nestlé. Her successor at LVMHâs HR division has not yet been announced. Gaemperle is leaving to âpursue new projects,â LVMH said in a statement Wednesday.

MEDIA AND TECHNOLOGY

Marc Jacobs named US Vogueâs first guest editor. The December issue hones in on themes of dance and creative expression. Kaia Gerber fronts two covers by Steven Meisel and Anna Weyant.

Meta fined â¬798 million ($839 million) by EU over abusing classified ads dominance. The European Commission ordered Meta to stop tying its classified-ads service to Facebookâs sprawling social media platform. The company is also ordered to refrain from imposing unfair trading conditions on rival second-hand goods platforms.

Compiled by Yola Mzizi.