One unfortunate aspect of the world of Miles & Points is that loyalty program devaluations are bound to occur.

Sometimes, we’re at least given the courtesy of advance warning, but all too often, you wake up one morning only to find that your points are less valuable or less flexible than they were went you went to sleep.

While you can never fully protect yourself and your points, there are some steps you can take to at least mitigate the chances that you’ll get stung by loyalty program devaluations.

Loyalty Program Devaluations Are Never Pleasant

Loyalty program devaluations are as inevitable as they are unpredictable (and unfortunate). As members, we’re at the mercy of whatever programs decide to do, and there’s not much we can do to avoid them outright.

In the last couple of years alone, there have been a number of significant loyalty program devaluations that turned once compelling programs and sweet spots into things to avoid altogether.

Some of the more prominent ones that come to mind include:

Devaluations also rear their ugly heads in many forms, including (but not limited to) the following:

- Increasing the number of points required for a specific flight/hotel stay

- Increasing the amount of taxes and fees required for a specific itinerary (while the cost in points remains the same)

- Increasing the thresholds for attaining elite status (or weakening the benefits offered at various tiers)

- Removing a transfer partner (therefore making your points less flexible)

While loyalty programs usually try to spin the devaluations as enhancements or providing better value to members, the opposite is almost always the case.

When Lufthansa recently announced “exciting changes” coming to its Miles & More program, it portrayed a shift from fixed pricing to dynamic pricing as wholly positive. However, the cost for many awards is increasing – sometimes significantly – and the value of your miles in the program is decreasing.

One of my favourite devaluation announcements came from Cathay Pacific Asia Miles, which published a reference to devaluing the program in an FAQ on its website, only to dodge its own question altogether and remove it a few hours later.

Some airlines offer an announcement and detailed breakdown of changes in advance of them taking effect, which at least offers members the chance to redeem points at the current levels before they change. This seems like the minimum courtesy a program could offer its members.

Otherwise, program devaluations are made quietly, and members of the Miles & Points community are left to their own devices to piece everything together. Casual enthusiasts might not even realize that their points have been devalued.

Furthermore, with many programs moving away from fixed costs and venturing towards dynamic pricing, devaluations are becoming harder to detect.

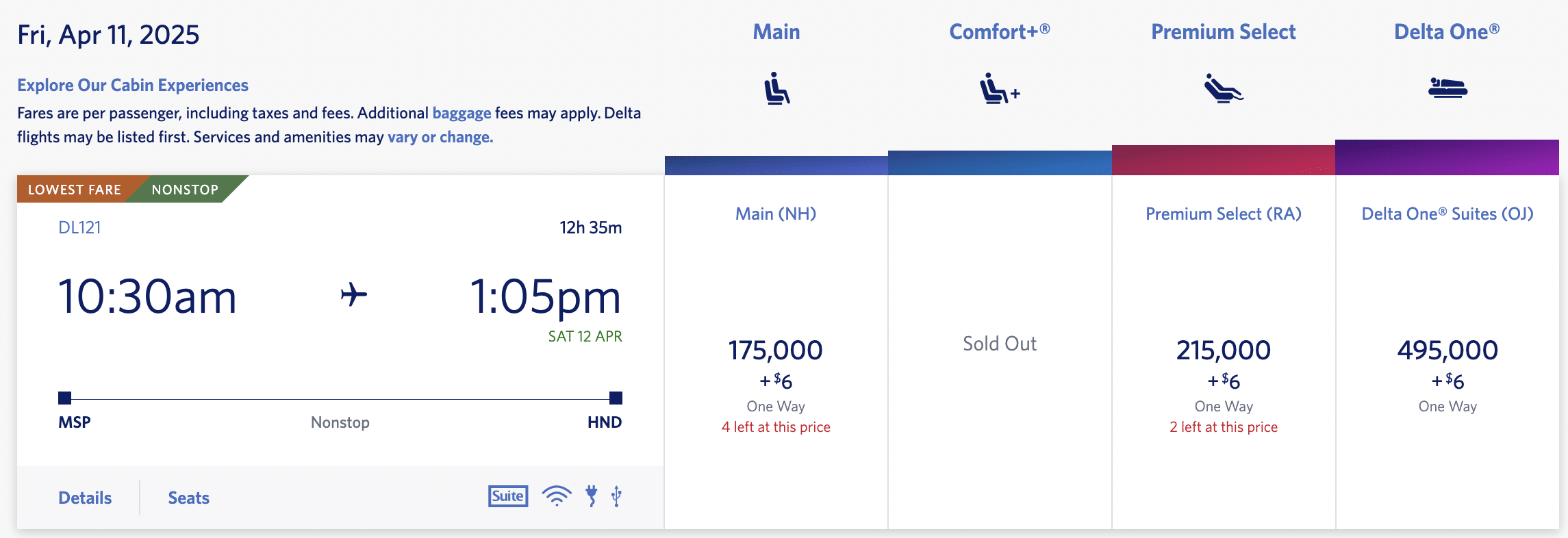

A common practice these days is for programs to list “starting at” prices for redemptions. While you may find flights at those levels – often referred to as “Saver” awards – the sky’s the limit for anything above that.

Lastly, in Canada, some devaluations hit harder than others, in that we’re often subject to sub-par transfer ratios to programs.

For example, if your primary access point to Air France KLM Flying Blue is through American Express Membership Rewards, then you’re subject to a transfer ratio of 1:0.75 (1,000 Membership Rewards points = 750 Flying Blue miles).

Earlier this year, Flying Blue raised the minimum price for transatlantic business class redemptions from 50,000 miles to 60,000 miles. On paper, that’s an increase of 10,000 miles, but with the transfer ratio taken into consideration, it’s actually moved from 66,667 MR points to 80,000 MR points.

At that price, you’re much better off booking transatlantic flight rewards through Aeroplan (availability permitting), since you’ll pay 60,000–70,000 points (assuming you book with a partner airline such as Swiss or Turkish Airlines). Plus, Membership Rewards points transfer to Aeroplan at a 1:1 ratio.

How to Protect Your Points from Devaluations

With the above in mind, let’s explore some of the ways you can protect your points from devaluations, which recognizing that you’re bound to encounter one (or more) during your Miles & Points journey.

Keep Transferable Points Transferable

The best points to earn are transferable points, which give you the greatest flexibility for redemptions.

In Canada, the best points to earn for travel are American Express Membership Rewards (which transfer to six airline partners and two hotel partners) and RBC Avion points (which transfer to four airline partners).

When planning out a redemption, your best bet is to keep your transferable points in your account until you’ve found a flight or hotel stay that you’d like to book. Then, transfer them out, and book right away to secure it at its current price (or leverage an award hold until your points arrive).

If you were to speculatively transfer your transferable points into your loyalty program of choice, should that program devalue unexpectedly, all of your points eggs are in one points basket, and you could be out of luck.

Credit Cards with Transferable Points

| Credit Card | Best Offer | Value | |

|---|---|---|---|

|

130,000 MR points $799 annual fee |

130,000 MR points | $1,794 |

Apply Now |

|

70,000 MR points $250 annual fee |

70,000 MR points | $1,676 |

Apply Now |

|

100,000 MR points $799 annual fee |

100,000 MR points | $1,141 |

Apply Now |

|

55,000 RBC Avion points† $120 annual fee |

55,000 RBC Avion points† | $1,080 |

Apply Now |

|

55,000 RBC Avion points† $120 annual fee |

55,000 RBC Avion points† | $1,080 |

Apply Now |

|

40,000 MR points $199 annual fee |

40,000 MR points | $846 |

Apply Now |

|

Up to 70,000 RBC Avion points† $399 annual fee |

Up to 70,000 RBC Avion points† | $801 |

Apply Now |

|

35,000 RBC Avion points $175 annual fee |

35,000 RBC Avion points | $700 |

Apply Now |

|

35,000 RBC Avion points $120 annual fee |

35,000 RBC Avion points | $580 |

Apply Now |

|

15,000 MR points $156 annual fee |

15,000 MR points | $372 |

Apply Now |

Earn & Burn (with Purpose)

If you’ve been around the Miles & Points world for a minute, you’ve likely heard people recommending that you earn and burn as often as possible.

Unfortunately, points are a terrible investment, and they don’t tend to appreciate over time. If you hold out on a redemption for too long, there’s a good chance that you’ll have to pay much more than you would have if you booked much sooner.

While earning points across multiple programs certainly gives you more options, I’d recommend that you set a clear goal, focus on the points programs that will help you meet that goal, and then book it as soon as you reach it.

For example, my entry into Miles & Points came with wanting to fly in business class for our honeymoon (way back in 2018).

We set our goal of flying with Turkish Airlines using Aeroplan points, and then worked backwards from there by paying for as much of our wedding as possible with credit cards that earned Aeroplan points and American Express Membership Rewards points.

It didn’t take long to earn enough points to book our flights, at which point we set a new goal of earning hotel points for some aspirational stays along the way, and continued onward from there.

Having a clear goal in place will help you create a plan on how to get there, and you can be intentional with your points strategy.

Knowledge Is Power

Oftentimes, the same flight can be booked with multiple programs, which means that even if the flight you’ve had your eyes on is devalued in one program, it’s likely still available for less through another.

Let’s use a hypothetical situation to illustrate this.

British Airways flights can be booked with a variety of loyalty programs, including (but not limited to) British Airways Executive Club, Cathay Pacific Asia Miles, American Airlines AAdvantage, Finnair Plus, and Qatar Airways Privilege Club.

All of these programs are accessible through transferable points programs and/or co-branded credit cards in Canada (or by converting points from within the Avios ecosystem).

If the cost were to increase in one program, then your first bet should be to look at the cost available through other programs, and then transfer your points accordingly. (This is another reminder to keep your transferable points flexible for as long as possible).

In fact, this is exactly what happened last year when American Airlines and Alaska Airlines flights were devalued from British Airways Executive Club, but they were still bookable through Qatar Airways Privilege Club at the old prices (at least temporarily).

By simply converting your British Airways Avios into Qatar Airways Avios (instantly and at no cost), you could book the same flights at the pre-devaluation prices.

Book Now (and Think Later)

Lastly, if you’re able to be flexible with your travel plans, it’s worthwhile to consider pouncing on opportunities as they come up and then planning a trip around it afterwards.

After all, you’re only ever guaranteed the price at which you can book something today – it could rise tomorrow, and then you’re out of luck.

If you’ve had your eyes set on a particular redemption and it becomes available either through an unexpected award drop or at saver-level pricing, consider booking it right away and building a trip around it later.

If your plans change, you should be able to cancel your booking for free or at a reasonable cost, which is something that you can’t often do with cash bookings for the same things.

For example, one of the most valuable uses of Marriott Bonvoy points was to make a five-night award booking at the JW Marriott Masai Mara Lodge in Kenya.

While Marriott Bonvoy has used dynamic pricing for quite some time, the cost in points has been far more attractive than the cost in cash, and there was plenty of opportunity to score outsized value.

Not long ago, you could book a stay for as few as 75,000 points per night (rising to about 120,000 points per night). These prices were very attractive given that cash prices hover at $1,750 (USD) per night or more.

After the most recent devaluation, in which Marriott Bonvoy seemingly raised the ceiling on award prices, the lowest price you’ll see in the next 12 months is 196,000 points per night, though it often costs 200,000 points per night or more.

I’m personally kicking myself for not taking advantage of a stay when I had the chance, since now I’m going to have to fork over way more points than I’d like to for the same experience.

Of course, this begs the question of whether you’re doing something because you want to or just because you can, which is a topic for another article.

Conclusion

It’s impossible to avoid loyalty program devaluations, since we’re left at the mercy of whatever changes (good or (more often) bad) the programs decide to make, with or without notice.

As frustrating as it is, there are some ways in which you can protect your hard-earned points from devaluations, which we’ve explored in this guide.

With more and more programs moving to dynamic pricing, I’d encourage everyone to earn and burn as often as possible to ensure you can get the best value from your points.