Pandora, the worldâs biggest jewellery maker, raised its full-year growth outlook on Monday, presenting a more upbeat outlook than some other consumer goods companies as it continues to expand its product range.

The company said its operating profit rose to 1.34 billion Danish crowns ($196.25 million) in the second quarter from 1.19 billion a year earlier, in line with a forecast of 1.3 billion in a company-compiled poll.

Pandora increased its full-year organic growth guidance again – having already raised it in May – to between 9 percent and 12 percent compared to its previous guidance of 8-10 percent. It kept its operating margin guidance at around 25 percent.

âWe are again raising revenue guidance for 2024 and look to the second half of the year with optimism,â CEO Alexander Lacik said in a statement.

A long list of company earnings has recently pointed to a softening of pricing power or weakness in consumer spending, and luxury groups such as LVMH and Burberry have announced disappointing sales numbers.

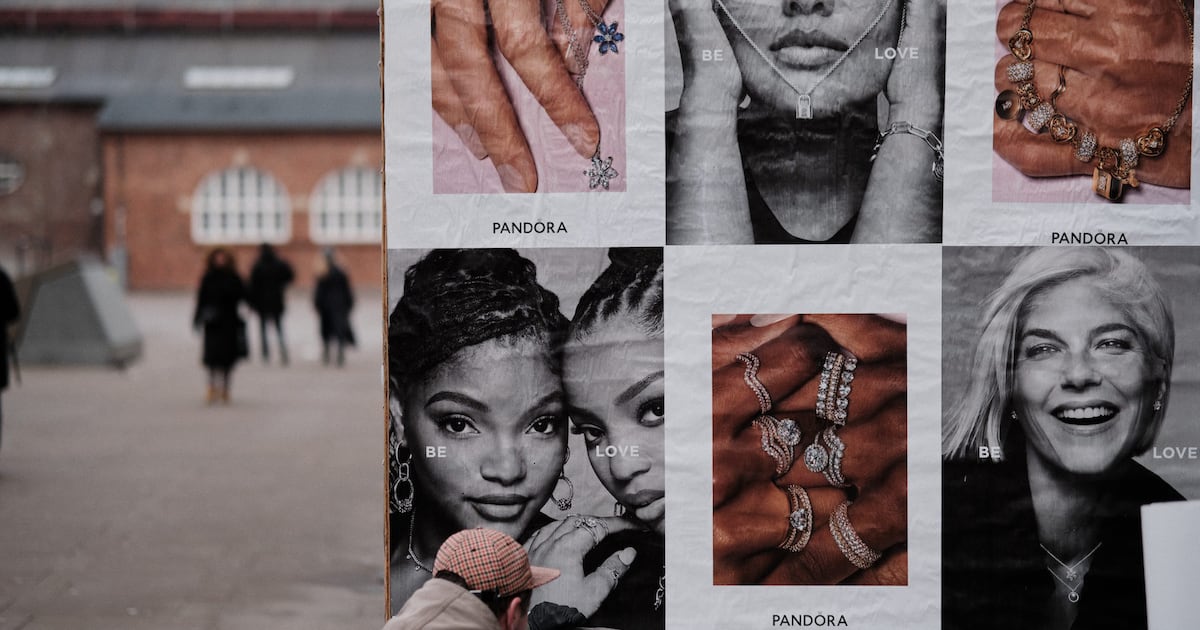

Pandora has invested heavily in marketing, store openings, and broadening its range of rings, necklaces, and lab-grown diamonds, though its charm bracelets ranging from $60 to more than $2,000 still make up a majority of sales.

âOur strategy continues to take Pandora to new heights despite general consumer spending being somewhat sluggish,â Lacik said.

âWe have successfully started the journey to make Pandora known as a full jewellery brand, and our results show that consumers like what they see,â he added.

By Isabelle Yr Carlsson and Terje Solsvik, editing by Stine Jacobsen and Susan Fenton

Learn more:

How Jewellery Retailer Pandora Is Evolving and Elevating Its Brand

A four-part strategy is ushering in a new phase of growth at global jewellery brand Pandora. Its chief marketing officer, Mary Carmen Gasco-Buisson, discusses the investments made across product design and brand marketing to capture the attention of new consumers.